YOUR DREAM. YOUR SPACE. YOUR WAY.

(206) 478-7333

Optimize Your Investment Strategy with Ease

As a Managing Broker with Coldwell Banker Danforth serving Seattle and Everett, I bring over 25 years of experience in the real estate industry to help you optimize your investment strategy. Access our free Investment Cash Flow & Equity Worksheet to evaluate your next residential deal like a pro and explore curated resources tailored to investors.

How the Investment Cashflow and Equity Worksheet Works

This worksheet is designed to evaluate the financial potential of real estate investments by integrating three key principles: leverage, appreciation, and cash flow. The tool is organized into six tabs, each serving a specific purpose to help you analyze different aspects of your investment.

Input

Tab

This is where the analysis begins.

You’ll enter specific property details, including:

Purchase price

Down payment

Projected rents

Estimated expenses (maintenance, property taxes, insurance, etc.)

Annual rent increases and expense escalations

Formulas-At-A-Glance Tab

This tab simplifies complex financial calculations. It provides:

Clear formulas for how cash flow, equity, and appreciation are calculated.

A snapshot of your property's performance metrics.

Cash Flow

Tab

This tab shows the year-over-year cash flow projections, taking into account:

Rent collected

Expenses incurred

Mortgage payments

Net cash flow (profit after covering all costs)

Equity Projections

Tab

The real power of this tool lies in its

long-term equity projections, which help you visualize:

How the property’s value grows with appreciation.

How your mortgage balance decreases over time through principal payments.

Your net equity at different milestones (e.g., 5 years, 10 years, 20 years).

Expense Calculations Tab

This tab dives deeper into the costs of owning and maintaining the property:

It ensures your projections are accurate by factoring in recurring and one-time expenses.

You can adjust values to reflect realistic scenarios.

Mortgage Amortization Tabs

For properties with one or two mortgages, these tabs provide:

A detailed breakdown of how your mortgage payments are applied to principal and interest over time.

A clearer understanding of how equity builds as you pay off the loan.

Who's This Perfect For

Real Estate Developers

Fix-and-Flip Enthusiasts

DIY Property Investors

Rental Property Owners

Data-Driven Investors

Passive Income Seekers

Portfolio Investors

First-Time Real Estate Investors

House Hackers

Looking to make a smart real estate investment in Snohomish or King County? I'm here to guide you every step of the way as your dedicated real estate broker!

Sage Sanders

Managing Broker

Coldwell Banker Danforth Seattle & Everett

425-333-1315

As a Managing Broker with Coldwell Banker Danforth, I bring extensive knowledge and strategic expertise to real estate investment. With decades of experience in the Seattle and Everett markets, I'm adept at identifying prime investment opportunities. My focus is on delivering personalized, data-driven insights that ensure each investment decision is both informed and strategically aligned with your financial aspirations. Let’s navigate the complexities of real estate investing together and achieve success.

Let’s Discuss Your Investment Goals

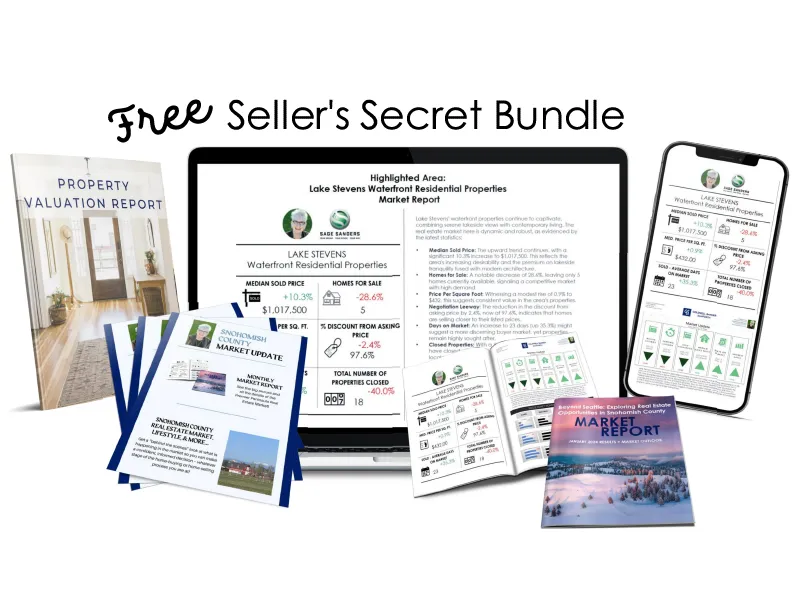

Considering SELLING a Home?

SELLER SECRETS

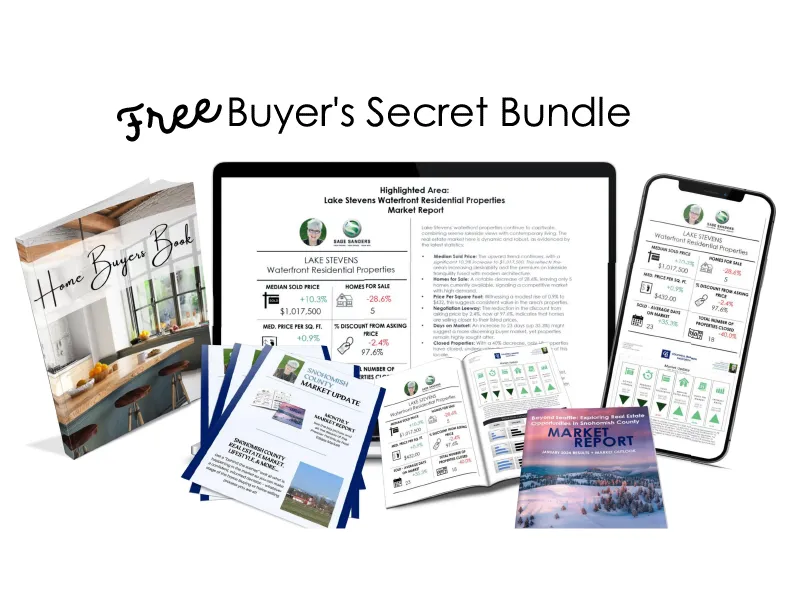

Considering BUYING a Home?

BUYER SECRETS

Not Ready Yet... But I Want to Stay Informed

PROPERTY INSIGHTS ONLY

Real Stories from Real Clients

I take pride in providing personalized, expert guidance to my clients. Here’s what they have to say about partnering with me on their real estate journey.

RESOURCES

LEGAL

FEATURED CITIES

© Copyright 2026. Sage Sanders, Managing Broker with Coldwell Banker Danforth. All Rights Reserved.

Facebook

Instagram

LinkedIn

Youtube

Website

Mail